Reserve Bank of India celebrates its 84th Foundation Day on April1,2019

KS Diwan/ royalpatiala.in/ Chandigarh

India’s central banking institution -Reserve Bank of India (RBI) was founded on 1 April 1935 to respond to economic troubles after the First World War. Though originally privately owned, since nationalisation in 1949, the Reserve Bank is fully owned by the Government of India. RBI, which controls the monetary policy of India, commenced its operations on 1 April 1935 in accordance with the Reserve Bank of India Act, 1934. Although RBI was established as a private entity, it was nationalised from 1st January 1949 by Government of India through ‘Transfer of Public Ownership Act, 1948’. Initially, RBI’s headquarters was in Calcutta. It was moved to Mumbai in the year 1937. RBI controls the issuance and supply of the Indian rupee.

The establishment of RBI was recommended by Hilton Young Commission to the then British Government.The Bank was conceptualized as per the guidelines, working style and outlook presented by B. R. Ambedkar in his book titled “The Problem of the Rupee – Its origin and its solution”.

The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937. The Central Office is where the Governor sits and where policies are formulated.The RBI plays an important part in the Development Strategy of the Government of India. Financial Year of RBI is 1st July to 30th June.

Logo of RBI has a tiger and a palm tree. It was inspired by East India Company’s Double Mohur which had a lion instead of tiger.

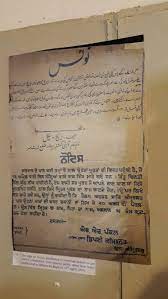

Preamble

The Preamble of the Reserve Bank of India describes the basic functions of the Reserve Bank as:

“to regulate the issue of Bank notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage; to have a modern monetary policy framework to meet the challenge of an increasingly complex economy, to maintain price stability while keeping in mind the objective of growth.”