Detail list of all GST Council decisions, announces New Slabs, implementation date

Kanwar Inder singh/ royalpatiala.in News/ September 3,2025

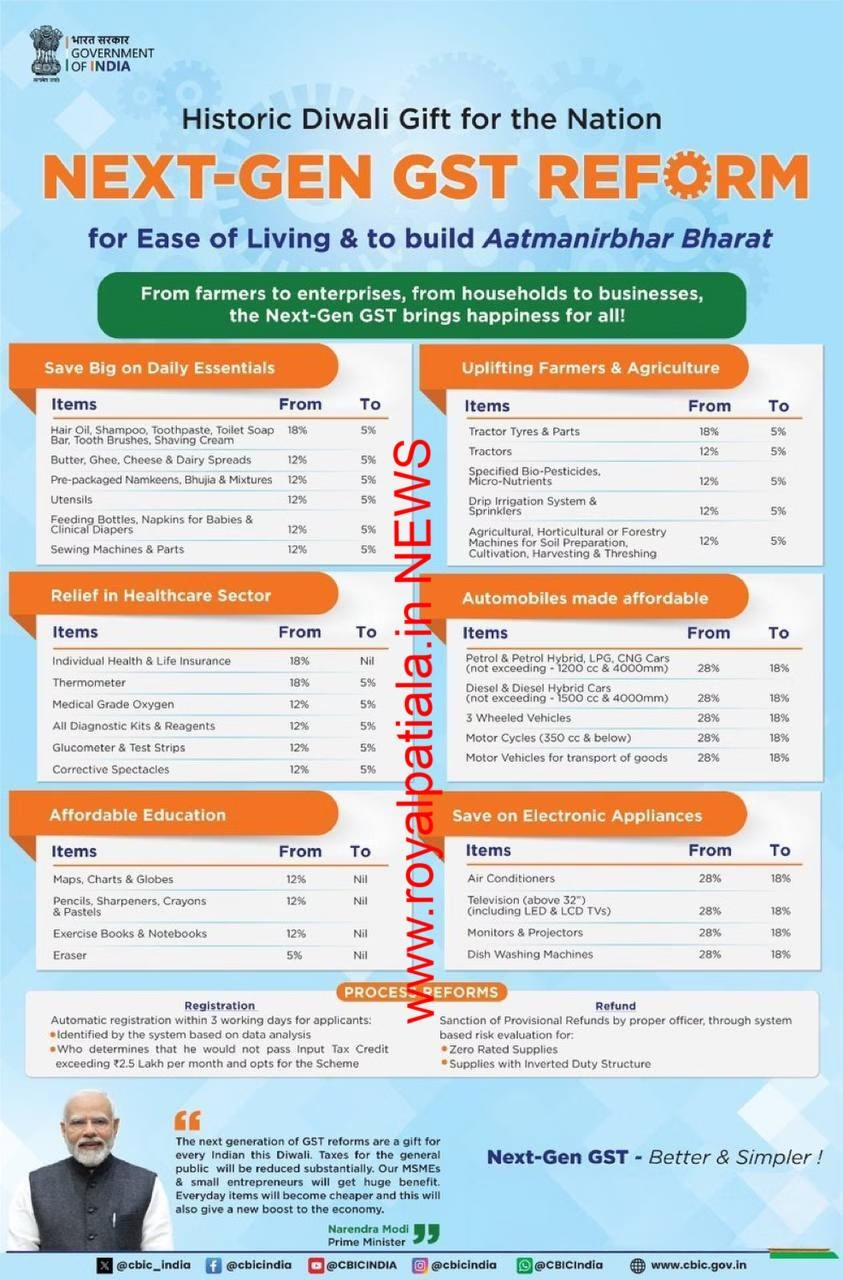

GST Council approves rate rationalisation with a focus on Common-man, Labour-intensive Industries, Farmers and Agriculture, Health, Key Drivers of the economy

Exemption of GST on all individual life insurance policies whether term life, ULIP or endowment policies and reinsurance thereof to make insurance affordable for the common man and increase the insurance coverage in the country.

Exemption of GST on all individual health insurance policies (including family floater policies and policies for senior citizens) and reinsurance thereof to make insurance affordable for the common man and increase the insurance coverage in the country

Rationalisation of the current 4-tiered tax rate structure into a citizen-friendly ‘Simple Tax’ – a 2 rate structure with a Standard Rate of 18% and a Merit Rate of 5%; a special de-merit rate of 40% for a select few goods and services

Reduction of GST from 18% OR 12% to 5% on a host of common man items such as, hair oil, toilet soap bars, shampoos, toothbrushes, toothpaste, Bicycles, Tableware, kitchenware, other household articles, et al

Reduction of GST from 5% to NIL on Ultra-High Temperature (UHT) milk, Prepackaged and labelled chena or paneer; All the Indian Breads will see NIL rates (Chapati or roti, paratha, parotta, etc)

Reduction of GST from 12% OR 18% to 5% on almost all of the food items such as packaged namkeens, Bhujia, Sauces, Pasta, Instant Noodles, Chocolates, Coffee, Preserved Meat, Cornflakes, Butter, Ghee, etc.

Reduction of GST from 28% to 18% on Air-conditioning machines, TVs~32 inch (all TVs now at 18%), Dishwashing machines, Small cars, Motorcycles equal to or less than 350 CC

Reduction of GST from 12% to 5% on agricultural goods, such as tractors, agricultural, horticultural or forestry machinery for soil preparation or cultivation, harvesting or threshing machinery, including straw or fodder balers, grass or hay mowers, composting machines etc

Reduction of GST from 12% to 5% on labour intensive goods such as Handicrafts, Marble and travertine blocks, granite blocks, and Intermediate leather goods

Reduction of GST from 28% to 18% on Cement

Reduction of GST from 12% to NIL on 33 lifesaving drugs and medicines and from 5% to NIL on 3 lifesaving drugs & medicines used for treatment of cancer, rare diseases and other severe chronic diseases.

Reduction of GST on all other drugs and medicines from 12% to 5%.

Reduction of GST from 18% to 5% on various medical apparatus and devices used for medical, surgical, dental or veterinary usage or for physical or chemical analysis

Reduction of GST from 12% to 5% on various medical equipment and supplies devices such as wadding gauze, bandages, diagnostic kits and reagents, blood glucose monitoring system (Glucometer) medical devices, etc

Reduction of GST from 28% to 18% on Small Cars and Motorcycles equal to or below 350cc

Reduction of GST from 28% to 18% on buses, trucks, ambulances etc

Uniform rate of 18% on all auto parts irrespective of their HS code; Three-Wheelers from 28% to 18%

Correction of long-pending inverted duty structure for the manmade textile sector by reducing GST rate on manmade fibre from 18% to 5% and manmade yarn from 12% to 5%

Correction of inverted duty structure in fertilizer sector by reducing GST from 18% to 5% on Sulphuric acid, Nitric acid and Ammonia

Reduction of GST from 12% to 5% on renewable energy devices and parts for their manufacture

Reduction of GST from 12% to 5% on “Hotel Accommodation” services having value less than or equal to Rs. 7,500 per unit per day or equivalent

Reduction of GST from 18% to 5% on beauty and physical well-being services used by common man including services of gyms, salons, barbers, yoga centres, etc

The 56th meeting of the GST Council was held in New Delhi under the chairpersonship of the Union Finance & Corporate Affairs Minister Nirmala Sitharaman. The GST Council inter-alia made the recommendations relating to changes in GST tax rates, provide relief to individuals, common man, aspirational middle class and measures for facilitation of trade in GST. FAQs are also being issued for clarification of doubts. The recommendations made by the 56th GST Council are as below:

- CHANGES IN GST RATES OF GOODS AND SERVICES

- Recommendations relating to GST rates on goods

- Changes in GST rates of goods

The HSN wise rate changes are at Annexure -I and sector wise rate changes are at Annexure -II

- Other changes relating to goods

- It has been decided that the GST will be levied on Retail Sale Price (RSP) instead of transaction value on Pan Masala, Gutkha, Cigarettes, Unmanufactured tobacco, Chewing tobacco like Zarda.

- It has been decided to grant ad hoc IGST and compensation cess exemption on new armoured sedan Car imported by the President’s Secretariat for the President of India.

- Recommendations relating to GST rates on services

- Changes in GST rates of services

The HSN wise rate changes are at Annexure -III and Sector wise rate changes are at Annexure -IV.

- Other changes relating to services

- The Council has recommended to add Explanations to the definition of ‘specified premises’ in the context of taxability of restaurant services in order to clarify the position that a stand-alone restaurant cannot declare itself as a ‘specified premises’ and consequently cannot avail the option of paying GST at the rate of 18% with ITC.

- The Council has recommended to align the valuation rules with the change in the tax rate applicable to lottery tickets, certain amendments in the GST Valuation rules are being carried out.

- Recommendation relating to date of implementation

The Council was of the view that the changes in GST rates of goods and services need to be implemented with effect from 22nd September 2025. However, keeping in view the requirement of funds to fulfill the obligation under the compensation cess account, the Council decided that the changes in GST rates may be implemented in a phased manner as follows:

The changes in GST rates on services will be implemented with effect from 22ndSeptember 2025.

The changes in GST rates of all goods exceptpan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi, will be implemented with effect from 22nd September 2025.

Pan Masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi will continue at the existing rates of GST and compensation cess where applicable, till loan and interest payment obligations under the compensation cess account are completely discharged.

Based on c) above, Union Finance Minister and Chairperson of the GST Council may decide the actual date of transition to the revised rates of GST approved by the Council for the above-mentioned goods.

Pending requisite amendments in CGST Act, 2017, Central Board of Indirect Taxes and Customs (CBIC) shall administratively start implementation of the revised system of grant of 90% provisional refunds arising out of Inverted Duty structure on the basis of data analysis and risk evaluation done by the system, as in the case of risk based provisional refunds on account of zero-rated supplies.

- MEASURES FOR FACILITATION OF TRADE

- Process Reforms

- GST Council has taken various decisions and recommended various measures to facilitate trade. The process reforms and other measures related to GST law and Procedure are at Annexure -V. The date of implementation of these process reforms will be notified in due course.

- Operationalization of the Goods and Services Tax Appellate Tribunal (GSTAT)

The Goods and Services Tax Appellate Tribunal (GSTAT) will be made operational for accepting appeals before end of September and will commence hearing before end of December this year. The Council also recommended the date of 30.06.2026 for limitation of filing of backlog appeals. The Principal Bench of the GSTAT will also serve as the National Appellate Authority for Advance Ruling. These measures will significantly strengthen the institutional framework of GST by providing a robust mechanism for dispute resolution, ensuring consistency in advance rulings, and offering greater certainty to taxpayers. This will further enhance trust, transparency, and ease of doing business under the GST regime.

Annexure-I

GOODS

| S. No. | Chapter / Heading / Sub-heading / Tariff item | Description | From | To | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 01012100, 010129 | Live horses | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0401 | Ultra-High Temperature (UHT) milk | 5% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0402 91 10, 0402 99 20 | Condensed milk | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0405

| Butter and other fats (i.e. ghee, butter oil, etc.) and oils derived from milk; dairy spreads | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0406 | Cheese | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0406 | Chena or paneer, pre-packaged and labelled | 5% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0801 | Brazil nuts, dried, whether or not Shelled or Peeled | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0802 | Other nuts, dried, whether or not shelled or peeled, such as Almonds, Hazelnuts or filberts (Corylus spp.), Chestnuts (Castanea spp.), Pistachios, Macadamia nuts, Kola nuts (Cola spp.), Pine nuts | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0804 | Dates (soft or hard), figs, pineapples, avocados, guavas, mangoes (other than mangoes sliced, dried) and mangosteens, dried | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0805 | Citrus fruit, such as Oranges, Mandarins (including tangerines and satsumas); clementines, wilkings and similar citrus hybrids, Grapefruit, including pomelos, Lemons (Citrus limon, Citrus limonum) and limes (Citrus aurantifolia, Citrus latifolia), dried | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0813 | Fruit, dried, other than that of headings 0801 to 0806; mixtures of nuts or dried fruits of Chapter 8 (other than dried tamarind) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1107 | Malt, whether or not roasted | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1108 | Starches; inulin | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1302 | Vegetable saps and extracts; pectic substances, pectinates and pectates; agar-agar and other mucilages and thickeners, whether or not modified, derived from vegetable products | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1404 90 10 | Bidi wrapper leaves (tendu) | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1404 90 50 | Indian katha | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1501 | Pig fats (including lard) and poultry fat, other than that of heading 0209 or 1503 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1502 | Fats of bovine animals, sheep or goats, other than those of heading 1503 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1503 | Lard stearin, lard oil, oleo stearin, oleo-oil and tallow oil, not emulsified or mixed or otherwise prepared | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1504 | Fats and oils and their fractions, of fish or marine mammals, whether or not refined, but not chemically modified | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1505 | Wool grease and fatty substances derived therefrom (including lanolin) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1506 | Other animal fats and oils and their fractions, whether or not refined, but not chemically modified | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1516 | Animal or microbial fats and animal or microbial oils and their fractions, partly or wholly hydrogenated, inter-esterified, re-esterified or elaidinised, whether or not refined, but not further prepared | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1517 | Edible mixtures or preparations of animal fats or microbial fats or animal oils or microbial oils or of fractions of different animal fats or microbial fats or animal oils or microbial oils of this Chapter, other than edible fats or oils or their fractions of heading 1516 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1517 10 | All goods i.e. Margarine, Linoxyn | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1518 | Animal or microbial fats and animal or microbial oils and their fractions, boiled, oxidised, dehydrated, sulphurised, blown, polymerised by heat in vacuum or in inert gas or otherwise chemically modified, excluding those of heading 1516; inedible mixtures or preparations of animal, vegetable or microbial fats or oils or of fractions of different fats or oils of this chapter, not elsewhere specified of included | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1520 00 00 | Glycerol, crude; glycerol waters and glycerol lyes | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1521 | Vegetable waxes (other than triglycerides), Beeswax, other insect waxes and spermaceti, whether or not refined or coloured | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1522 | Degras, residues resulting from the treatment of fatty substances or animal or vegetable waxes | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1601 | Sausages and similar products, of meat, meat offal, blood or insects; food preparations based on these products | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1602 | Other prepared or preserved meat, meat offal, blood or insects | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1603 | Extracts and juices of meat, fish or crustaceans, molluscs or other aquatic invertebrates | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1604 | Prepared or preserved fish; caviar and caviar substitutes prepared from fish eggs | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1605 | Crustaceans, molluscs and other aquatic invertebrates prepared or preserved | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1701 91, 1701 99 | All goods, including refined sugar containing added flavouring or colouring matter, sugar cubes | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1702 | Other sugars, including chemically pure lactose, maltose, glucose and fructose, in solid form; sugar syrups not containing added flavouring or colouring matter; artificial honey, whether or not mixed with natural honey; caramel | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1704 | Sugar boiled confectionery | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1704 | Sugar confectionery | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1804 | Cocoa butter, fat and oil | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1805 | Cocoa powder, not containing added sugar or sweetening matter | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1806 | Chocolates and other food preparations containing cocoa | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1901 [other than 1901 20 00] | Malt extract, food preparations of flour, groats, meal, starch or malt extract, not containing cocoa or containing less than 40% by weight of cocoa calculated on a totally defatted basis, not elsewhere specified or included; food preparations of goods of heading 0401 to 0404, not containing cocoa or containing less than 5% by weight of cocoa calculated on a totally defatted basis not elsewhere specified or included | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1902 | Pasta, whether or not cooked or stuffed (with meat or other substances) or otherwise prepared, such as spaghetti, macaroni, noodles, lasagne, gnocchi, ravioli, cannelloni; couscous, whether or not prepared | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1904 [other than 1904 10 20] | All goods i.e. Corn flakes, bulgar wheat, prepared foods obtained from cereal flakes, Fortified Rice Kernel (FRK) | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1905 | Pastry, cakes, biscuits and other bakers’ wares, whether or not containing cocoa; communion wafers, empty cachets of a kind suitable for pharmaceutical use, sealing wafers, rice paper and similar products (other than bread, pizza bread, khakhra, chapathi, roti) | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1905 90 30 | Extruded or expanded products, savoury or salted | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1905 | Pizza bread | 5% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1905 or 2106 | Khakhra, chapathi or roti | 5% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2001 | Vegetables, fruit, nuts and other edible parts of plants, prepared or preserved by vinegar or acetic acid | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2002 | Tomatoes prepared or preserved otherwise than by vinegar or acetic acid | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2003 | Mushrooms and truffles, prepared or preserved otherwise than by vinegar or acetic acid | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2004 | Other vegetables prepared or preserved otherwise than by vinegar or acetic acid, frozen, other than products of heading 2006 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2005 | Other vegetables prepared or preserved otherwise than by vinegar or acetic acid, not frozen, other than products of heading 2006 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2006 | Vegetables, fruit, nuts, fruit-peel and other parts of plants, preserved by sugar (drained, glacé or crystallised) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2007 | Jams, fruit jellies, marmalades, fruit or nut purée and fruit or nut pastes, obtained by cooking, whether or not containing added sugar or other sweetening matter | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2008 | Fruit, nuts and other edible parts of plants, otherwise prepared or preserved, whether or not containing added sugar or other sweetening matter or spirit, not elsewhere specified or included; such as Ground-nuts, Cashew nut, roasted, salted or roasted and salted, Other roasted nuts and seeds, squash of Mango, Lemon, Orange, Pineapple or other fruits | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2009 | Fruit or nut juices (including grape must) and vegetable juices, unfermented and not containing added spirit, whether or not containing added sugar or other sweetening matter | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2009 89 90 | Tender coconut water, pre-packaged and labelled | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2101 11, 2101 12 00 | Extracts, essences and concentrates of coffee, and preparations with a basis of these extracts, essences or concentrates or with a basis of coffee | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2101 20 | All goods i.e Extracts, essences and concentrates of tea or mate, and preparations with a basis of these extracts, essences or concentrates or with a basis of tea or mate | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2101 30 | Roasted chicory and other roasted coffee substitutes, and extracts, essences and concentrates thereof | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2102 | Yeasts (active and inactive); other single cell micro-organisms, dead (but not including vaccines of heading 3002); prepared baking powders | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2103 | All goods, including Sauces and preparations therefor, mixed condiments and mixed seasonings; mustard flour and meal and prepared mustard, Curry paste, mayonnaise and salad dressings | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2104 | Soups and broths and preparations therefor; homogenised composite food preparations | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2105 00 00 | Ice cream and other edible ice, whether or not containing cocoa | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2106 | Paratha, parotta and other Indian breads by any name called | 18% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2106 | Texturised vegetable proteins (soya bari), Bari made of pulses including mungodi and batters | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2106 90 | Namkeens, bhujia, mixture, chabena and similar edible preparations ready for consumption form (other than roasted gram), pre-packaged and labelled | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2106 90 20 | Pan masala* | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2106 90 91 | Diabetic foods | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2106 | Food preparations not elsewhere specified or included | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2201 | Drinking water packed in 20 litre bottles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2201 | Waters, including natural or artificial mineral waters and aerated waters, not containing added sugar or other sweetening matter nor flavoured | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 10 | All goods (including aerated waters), containing added sugar or other sweetening matter or flavoured | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 91 00, 2202 99 | Other non-alcoholic beverages | 18% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 99 | Plant-based milk drinks, ready for direct consumption as beverages | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 99 10 | Soya milk drinks | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 99 20 | Fruit pulp or fruit juice based drinks (other than Carbonated Beverages of Fruit Drink or Carbonated Beverages with Fruit Juice) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 | Carbonated Beverages of Fruit Drink or Carbonated Beverages with Fruit Juice | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 99 30 | Beverages containing milk | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2202 99 90 | Caffeinated Beverages | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2401* | Unmanufactured tobacco; tobacco refuse [other than tobacco leaves] | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2402* | Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2403* | Bidis | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2403* | Other manufactured tobacco and manufactured tobacco substitutes; “homogenised” or “reconstituted” tobacco; tobacco extracts and essences | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2404 11 00* | Products containing tobacco or reconstituted tobacco and intended for inhalation without combustion | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2404 19 00* | Products containing tobacco or nicotine substitutes and intended for inhalation without combustion | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2515 12 10 | Marble and travertine blocks | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2516 | Granite blocks | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2523 | Portland cement, aluminous cement, slag cement, super sulphate cement and similar hydraulic cements, whether or not coloured or in the form of clinkers | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2701 | Coal; briquettes, ovoids and similar solid fuels manufactured from coal | 5% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2702 | Lignite, whether or not agglomerated, excluding jet | 5% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2703 | Peat (including peat litter), whether or not agglomerated | 5% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 28 | Anaesthetics | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 28 | Potassium Iodate | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 28 | Steam | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2801 20 | Iodine | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2804 40 10 | Medical grade oxygen | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2807 | Sulphuric acid | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2808 | Nitric acid | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2814 | Ammonia | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2847 | Medicinal grade hydrogen peroxide | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 28 or 38 | Micronutrients, which are covered under serial number 1(g) of Schedule 1, Part (A) of the Fertilizer Control Order, 1985 and are manufactured by the manufacturers which are registered under the Fertilizer Control Order, 1985 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29 or 380893 | Gibberellic acid | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29061110 | Natural menthol | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29061110, 30, 3301

| Following goods from natural menthol namely:

| 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29061190 | Other than natural menthol | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29061190, 30, 3301

| Following goods made from other than natural menthol, namely:

| 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30 | The following drugs and medicines

| 5% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30 | The following drugs and medicines

| 12% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30 | All Drugs and medicines including:

| 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3001 | Glands and other organs for organo-therapeutic uses, dried, whether or not powdered; extracts of glands or other organs or of their secretions for organo-therapeutic uses; heparin and its salts; other human or animal substances prepared for therapeutic or prophylactic uses, not elsewhere specified or included | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3002 | Animal blood prepared for therapeutic, prophylactic or diagnostic uses; antisera and other blood fractions and modified immunological products, whether or not obtained by means of biotechnological processes; toxins, cultures of micro-organisms (excluding yeasts) and similar products | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3003 | Medicaments (excluding goods of heading 30.02, 30.05 or 30.06) consisting of two or more constituents which have been mixed together for therapeutic or prophylactic uses, not put up in measured doses or in forms or packings for retail sale, including Ayurvedic, Unani, Siddha, homoeopathic or Bio-chemic systems medicaments | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3004 | Medicaments (excluding goods of heading 30.02, 30.05 or 30.06) consisting of mixed or unmixed products for therapeutic or prophylactic uses, put up in measured doses (including those in the form of transdermal administration systems) or in forms or packings for retail sale, including Ayurvedic, Unani, homoeopathic siddha or Bio-chemic systems medicaments, put up for retail sale | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3005 | Wadding, gauze, bandages and similar articles (for example, dressings, adhesive plasters, poultices), impregnated or coated with pharmaceutical substances or put up in forms or packings for retail sale for medical, surgical, dental or veterinary purposes | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3006 | Pharmaceutical goods specified in Note 4 to this Chapter [i.e. Sterile surgical catgut, similar sterile suture materials (including sterile absorbable surgical or dental yarns) and sterile tissue adhesives for surgical wound closure; sterile laminaria and sterile laminaria tents; sterile absorbable surgical or dental haemostatics; sterile surgical or dental adhesion barriers, whether or not absorbable; Waste pharmaceuticals] [other than contraceptives] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3304 | Talcum powder, Face powder | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3305 | Hair oil, shampoo | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3306 | Dental floss, toothpaste | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 33061010 | Tooth powder | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3307 | Shaving cream, shaving lotion, aftershave lotion | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 33074100 | Odoriferous preparations which operate by burning (other than agarbattis, lobhan, dhoop batti, dhoop, sambhrani) | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3401 | Toilet Soap (other than industrial soap) in the form of bars, cakes, moulded pieces or shapes | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3406 | Candles, tapers and the like | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3406 | Handcrafted candles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3503 | Gelatin (including gelatin in rectangular (including square) sheets, whether or not surface-worked or coloured) and gelatin derivatives; isinglass; other glues of animal origin, excluding casein glues of heading 3501 | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3505 | Dextrins and other modified starches (for example, pregelatinised or esterified starches); glues based on starches, or on dextrins or other modified starches | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3605 00 10 | All goods-safety matches | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3701 | Photographic plates and film for x-ray for medical use | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3705 | Photographic plates and films, exposed and developed, other than cinematographic film | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3706 | Photographic plates and films, exposed and developed, whether or not incorporating sound track or consisting only of sound track, other than feature films | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3808 | The following Bio-pesticides, namely – 1 Bacillus thuringiensis var. israelensis 2 Bacillus thuringiensis var. kurstaki 3 Bacillus thuringiensis var. galleriae 4 Bacillus sphaericus 5 Trichoderma viride 6 Trichoderma harzianum 7 Pseudomonas fluoresens 8 Beauveriabassiana 9 NPV of Helicoverpaarmigera 10 NPV of Spodopteralitura 11 Neem based pesticides 12 Cymbopogan | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3818 | Silicon wafers | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3822 | All diagnostic kits and reagents | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3826 | Biodiesel (other than biodiesel supplied to Oil Marketing Companies for blending with High Speed Diesel) | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3926 | Feeding bottles; Plastic beads | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4007 | Latex Rubber Thread | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4011 | Rear tractor tyres and rear tractor tyre tubes | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4011 | New pneumatic tyres, of rubber [other than of a kind used on/in bicycles, cycle-rickshaws and three wheeled powered cycle rickshaws; rear tractor tyres; and of a kind used on aircraft] | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4011 70 00 | Tyre for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4013 90 49 | Tube for tractor tyres | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4014 | Nipples of feeding bottles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4015 | Surgical rubber gloves or medical examination rubber gloves | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4016 | Erasers | 5% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4016 | Rubber bands | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4107 | Leather further prepared after tanning or crusting, including parchment-dressed leather, of bovine (including buffalo) or equine animals, without hair on, whether or not split, other than leather of heading 4114 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4112 | Leather further prepared after tanning or crusting, including parchment-dressed leather, of sheep or lamb, without wool on, whether or not split, other than leather of heading 4114 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4113 | Leather further prepared after tanning or crusting, including parchment-dressed leather, of other animals, without wool or hair on, whether or not split, other than leather of heading 4114 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4114 | Chamois (including combination chamois) leather; patent leather and patent laminated leather; metallised leather | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4115 | Composition leather with a basis of leather or leather fibre, in slabs, sheets or strip, whether or not in rolls; parings and other waste of leather or of composition leather, not suitable for the manufacture of leather articles; leather dust, powder and flour | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4202 22,4202 29, 4202 31 10, 4202 31 90, 4202 32,4202 39 | Handicraft– Handbags including pouches and purses; jewellery box | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4202 22 20 | Hand bags and shopping bags, of cotton | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4202 22 30 | Hand bags and shopping bags, of jute | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4203 | Gloves specially designed for use in sports | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 44, 68, 83 | Idols of wood, stone [including marble] and metals [other than those made of precious metals] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 44 or any Chapter | The following goods, namely: —

| 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4404 | Hoopwood; split poles; piles, pickets and stakes of wood, pointed but not sawn lengthwise; wooden sticks, roughly trimmed but not turned, bent or otherwise worked, suitable for the manufacture of walking-sticks, umbrellas, tool handles or the like | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4405 | Wood wool; wood flour | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4406 | Railway or tramway sleepers (cross-ties) of wood | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4408 | Sheets for veneering (including those obtained by slicing laminated wood), for plywood or for similar laminated wood and other wood, sawn lengthwise, sliced or peeled, whether or not planed, sanded, spliced or end-jointed, of a thickness not exceeding 6 mm [for match splints] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4409 | Bamboo flooring | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4414 | Handicraft– Wooden frames for painting, photographs, mirrors etc | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4415 | Packing cases, boxes, crates, drums and similar packings, of wood; cable-drums of wood; pallets, box pallets and other load boards, of wood; pallet collars of wood | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4416, 4421 99 90 | Handicraft– Carved wood products, art ware/ decorative articles of wood (including inlay work, casks, barrel, vats) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4416 | Casks, barrels, vats, tubs and other coopers’ products and parts thereof, of wood, including staves | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4417 | Tools, tool bodies, tool handles, broom or brush bodies and handles, of wood; boot or shoe lasts and trees, of wood | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4418 | Bamboo wood building joinery | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4419 | Tableware and Kitchenware of wood | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4420 | Wood marquetry and inlaid wood; caskets and cases for jewellery or cutlery, and similar articles, of wood; statuettes and other ornaments, of wood; wooden articles of furniture not falling in Chapter 94 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4420 | Handicraft- Statuettes & other ornaments of wood, wood marquetry & inlaid, jewellery box, wood lathe and lacquer work [including lathe and lacquer work, ambadi sisal craft] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4421 | Other articles of wood; such as clothes hangers, Spools, cops, bobbins, sewing thread reels and the like of turned wood for various textile machinery, Match splints, Pencil slats, Parts of wood, namely oars, paddles and rudders for ships, boats and other similar floating structures, Parts of domestic decorative articles used as tableware and kitchenware [other than Wood paving blocks, articles of densified wood not elsewhere included or specified, Parts of domestic decorative articles used as tableware and kitchenware] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4502 00 00 | Natural cork, debacked or roughly squared, or in rectangular (including square) blocks, plates, sheets or strip (including sharp-edged blanks for corks or stoppers) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4503 | Articles of natural cork such as Corks and Stoppers, Shuttlecock cork bottom | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4503 90 90 4504 90 | Handicraft– Art ware of cork [including articles of sholapith] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4504 | Agglomerated cork (with or without a binding substance) and articles of agglomerated cork | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4701 | Mechanical wood pulp | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4702 | Chemical wood pulp, dissolving grades | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4703 | Chemical wood pulp, soda or sulphate, other than dissolving grades | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4704 | Chemical wood pulp, sulphite, other than dissolving grades | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4705 | Wood pulp obtained by a combination of mechanical and chemical pulping processes | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4706 | Pulps of fibres derived from recovered (waste and scrap) paper or paperboard or of other fibrous cellulosic material | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4802 | Uncoated paper and paperboard used for exercise book, graph book, laboratory notebook and notebooks | 12% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4802 | Uncoated paper and paperboard, of a kind used for writing, printing or other graphic purposes, and non-perforated punch-cards and punch tape paper, in rolls or rectangular (including square) sheets, of any size, other than paper of heading 4801 or 4803; [other than Uncoated paper and paperboard for exercise book, graph book, laboratory notebook and notebooks] | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4802 | Hand-made paper and paperboard | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4804 | Uncoated kraft paper and paperboard, in rolls or sheets, other than that of heading 4802 or 4803 | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4805 | Other uncoated paper and paperboard, in rolls or sheets, not further worked or processed than as specified in Note 3 to this Chapter | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4806 20 00 | Greaseproof papers | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4806 40 10 | Glassine papers | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4807 | Composite paper and paperboard (made by sticking flat layers of paper or paperboard together with an adhesive), not surface-coated or impregnated, whether or not internally reinforced, in rolls or sheets | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4808 | Paper and paperboard, corrugated (with or without glued flat surface sheets), creped, crinkled, embossed or perforated, in rolls or sheets, other than paper of the kind described in heading 4803 | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4810 | Paper and paperboard, coated on one or both sides with kaolin (China clay) or other inorganic substances, with or without a binder, and with no other coating, whether or not surface-coloured, surface-decorated or printed, in rolls or rectangular (including square) sheets of any size | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4817 30 | Boxes, pouches, wallets and writing compendiums, of paper or paperboard, containing an assortment of paper stationery | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4819 10, 4819 20 | Cartons, boxes and cases of,-

| 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4820 | Exercise book, graph book, & laboratory note book and notebooks | 12% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4823 | Paper pulp moulded trays | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 48 | Paper splints for matches, whether or not waxed, Asphaltic roofing sheets | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 48 | Paper Sacks/Bags and bio degradable bags | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4905 | Maps and hydrographic or similar charts of all kinds, including atlases, wall maps, topographical plans and globes, printed | 12% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5401 | Sewing thread of manmade filaments, whether or not put up for retail sale | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5402, 5403, 5404, 5405, 5406 | Synthetic or artificial filament yarns | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5402, 5404, 5406 | All goods | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5403, 5405, 5406 | All goods | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5501, 5502 | Synthetic or artificial filament tow | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5503, 5504, 5506, 5507 | Synthetic or artificial staple fibres | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5505 | Waste of manmade fibres | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5508 | Sewing thread of manmade staple fibres | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5509, 5510, 5511 | Yarn of manmade staple fibres | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5601 | Wadding of textile materials and articles thereof; such as absorbent cotton wool (except cigarette filter rods) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5602 | Felt, whether or not impregnate, coated, covered or laminated | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5603 | Nonwovens, whether or not impregnated, coated, covered or laminated | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5604 | Rubber thread and cord, textile covered; textile yarn, and strip and the like of heading 5404 or 5405, impregnated, coated, covered or sheathed with rubber or plastics | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5605 | Metallised yarn, whether or not gimped, being textile yarn or strip or the like of heading 5404 or 5405, combined with metal in the form of thread, strip or powder or covered with metal | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5606 | Gimped yarn, and strip and the like of heading 5404 or 5405, gimped (other than those of heading 5605 and gimped horsehair yarn); chenille yarn (including flock chenille yarn); loop wale-yarn | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5607 | Twine, cordage, ropes and cables, whether or not plaited or braided and whether or not impregnated, coated, covered or sheathed with rubber or plastics | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5609 | Articles of yarn, strip or the like of heading 5404 or 5405, twine, cordage, rope or cables, not elsewhere specified or included [other than products of coir] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5701 | Carpets and other textile floor coverings, knotted, whether or not made up | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5702 | Carpets and other textile floor coverings, woven, not tufted or flocked, whether or not made up, including “Kelem”, “Schumacks”, “Karamanie” and similar hand-woven rugs | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5703 | Carpets and other textile floor coverings (including Turf), tufted, whether or not made up | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5704 | Carpets and other textile floor coverings, of felt, not tufted or flocked, whether or not made up | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5705 | Other carpets and other textile floor coverings, whether or not made up; such as Mats and mattings including Bath Mats, where cotton predominates by weight, of Handloom, Cotton Rugs of handloom | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5802 | Terry towelling and similar woven terry fabrics, other than narrow fabrics of heading 5806; tufted textile fabrics, other than products of heading 5703 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5803 | Gauze, other than narrow fabrics of heading 5806 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5804 | Tulles and other net fabrics, not including woven, knitted or crocheted fabrics; lace in the piece, in strips or in motifs, other than fabrics of headings 6002 to 6006 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5805 | Hand-woven tapestries of the type Gobelins, Flanders, Aubusson, Beauvais and the like, and needle-worked tapestries (for example, petit point, cross stitch), whether or not made up | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5807 | Labels, badges and similar articles of textile materials, in the piece, in strips or cut to shape or size, not embroidered | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5808 | Braids in the piece; ornamental trimmings in the piece, without embroidery, other than knitted or crocheted; tassels, pompons and similar articles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5809 | Woven fabrics of metal thread and woven fabrics of metallised yarn of heading 5605, of a kind used in apparel, as furnishing fabrics or for similar purposes, not elsewhere specified or included; such as Zari borders | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5810 | Embroidery in the piece, in strips or in motifs, Embroidered badges, motifs and the like | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5811 | Quilted textile products in the piece, composed of one or more layers of textile materials assembled with padding by stitching or otherwise, other than embroidery of heading 5810 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5901 | Textile fabrics coated with gum or amylaceous substances, of a kind used for the outer covers of books or the like; tracing cloth; prepared painting canvas; buckram and similar stiffened textile fabrics of a kind used for hat foundations | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5902 | Tyre cord fabric of high tenacity yarn of nylon or other polyamides, polyesters or viscose rayon | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5903 | Textile fabrics impregnated, coated, covered or laminated with plastics, other than those of heading 5902 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5904 | Linoleum, whether or not cut to shape; floor coverings consisting of a coating or covering applied on a textile backing, whether or not cut to shape | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5905 | Textile wall coverings | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5906 | Rubberised textile fabrics, other than those of heading 5902 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5907 | Textile fabrics otherwise impregnated, coated or covered; painted canvas being theatrical scenery, studio back-cloths or the like | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5908 | Textile wicks, woven, plaited or knitted , for lamps, stoves, lighters, candles or the like; incandescent gas mantles and tubular knitted gas mantle fabric therefor, whether or not impregnated | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5909 | Textile hose piping and similar textile tubing, with or without lining, armour or accessories of other materials | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5910 | Transmission or conveyor belts or belting, of textile material, whether or not impregnated, coated, covered or laminated with plastics, or reinforced with metal or other material | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5911 | Textile products and articles, for technical uses, specified in Note 7 to this Chapter; such as Textile fabrics, felt and felt-lined woven fabrics, coated, covered or laminated with rubber, leather or other material, of a kind used for card clothing, and similar fabrics of a kind used for other technical purposes, including narrow fabrics made of velvet impregnated with rubber, for covering weaving spindles (weaving beams); Bolting cloth, whether or Not made up; Felt for cotton textile industries, woven; Woven textiles felt, whether or not impregnated or coated, of a kind commonly used in other machines, Cotton fabrics and articles used in machinery and plant, Jute fabrics and articles used in machinery or plant, Textile fabrics of metalised yarn of a kind commonly used in paper making or other machinery, Straining cloth of a kind used in oil presses or the like, including that of human hair, Paper maker’s felt, woven, Gaskets, washers, polishing discs and other machinery parts of textile articles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6117, 6214 | Handmade/hand embroidered shawls

| 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 61 | Articles of apparel and clothing accessories, knitted or crocheted, of sale value exceeding Rs. 2500 per piece | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 62 | Articles of apparel and clothing accessories, not knitted or crocheted, of sale value exceeding Rs. 2500 per piece | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 63 [other than 6309] | Other made up textile articles, sets of sale value exceeding Rs. 2500 per piece [other than Worn clothing and other worn articles; rags] | 12% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 64 | Footwear of sale value not exceeding Rs.2500 per pair | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6501 | Textile caps | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6505 | Hats (knitted/crocheted) or made up from lace or other textile fabrics | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6601 | Umbrellas and sun umbrellas (including walking-stick umbrellas, garden umbrellas and similar umbrellas) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6602 | Whips, riding-crops and the like | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6603 | Parts, trimmings and accessories of articles of heading 6601 or 6602 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6701 | Skins and other parts of birds with their feathers or down, feathers, parts of feathers, down and articles thereof (other than goods of heading 0505 and worked quills and scapes) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 68 | Sand lime bricks or Stone inlay work | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6802 | Handicraft Statues, statuettes, pedestals; high or low reliefs, crosses, figures of animals, bowls, vases, cups, cachou boxes, writing sets, ashtrays, paper weights, artificial fruit and foliage, etc.; other ornamental goods essentially of stone | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6802 | Handicraft -Carved stone products (e.g., statues, statuettes, figures of animals, writing sets, ashtray, candle stand) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 68159990 | Handicraft -Stone art ware, stone inlay work | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6909 | Pots, jars and similar articles of a kind used for the conveyance and packing of goods of ceramic | 12% | 5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6911 | Tableware, kitchenware, other household articles and toilet articles, of porcelain or china | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6912 | Tableware, kitchenware, other household articles and toilet articles, other than of porcelain or china | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 691200 10, 6912 00 20 | Handicraft-Tableware and kitchenware of clay and terracotta, other clay articles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6913 | Handicraft-Statues and other ornamental articles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6913 90 00 | Handicraft-Statuettes & other ornamental ceramic articles (incl blue potteries) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7009 92 00 | Handicraft-Ornamental framed mirrors | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7015 10 | Glasses for corrective spectacles and flint buttons | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7018 90 10 | Handicraft-Glass statues [other than those of crystal] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7020 00 90 | Handicraft-Glass art ware [ incl. pots, jars, votive, cask, cake cover, tulip bottle, vase ] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7020 | Globes for lamps and lanterns, Founts for kerosene wick lamps, Glass chimneys for lamps and lanterns | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7310 or 7326 | Mathematical boxes, geometry boxes and colour boxes | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7310, 7323, 7612, or 7615 | Milk cans made of Iron, Steel, or Aluminium | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7317 | Animal shoe nails | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7319 | Sewing needles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7321 or 8516 | Solar cookers | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7321 | Kerosene burners, kerosene stoves and wood burning stoves of iron or steel | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7323 | Table, kitchen or other household articles of iron & steel; Utensils | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7326 90 99 | Handicraft -Art ware of iron | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7418 | Table, kitchen or other household articles of copper; Utensils | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7419 80 30 | Brass Kerosene Pressure Stove | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7419 80 | Handicraft -Art ware of brass, copper/ copper alloys, electro plated with nickel/silver | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7615 | Table, kitchen or other household articles of aluminium; Utensils | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7616 99 90 | Handicraft -Aluminium art ware | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8214 | Pencil sharpeners | 12% | Nil | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8306 | Handicraft-Bells, gongs and like, non-electric, of base metal; statuettes, and other ornaments, of base metal; photograph, picture or similar frames, of base metal; mirrors of base metal; (including Bidriware, Panchloga artware, idol, Swamimalai bronze icons, dhokra jaali) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 84, 85 or 94 | Following renewable energy devices and parts for their manufacture:- (a) Bio-gas plant; (b) Solar power-based devices; (c) Solar power generator; (d) Wind mills, Wind Operated Electricity Generator (WOEG); (e) Waste to energy plants / devices; (f) Solar lantern / solar lamp; (g) Ocean waves/tidal waves energy devices/plants; (h) Photo voltaic cells, whether or not assembled in modules or made up into panels.

| 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8401 | Fuel elements (cartridges), non-irradiated, for nuclear reactors | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8407 | Spark-ignition reciprocating or rotary internal combustion piston engine [other than aircraft engines] | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8408 | Compression-ignition internal combustion piston engines (diesel or semi-diesel engines) | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8408 | Fixed Speed Diesel Engines of power not exceeding 15HP | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8408 20 20 | Agricultural Diesel Engine of cylinder capacity exceeding 250 cc for Tractor | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8409 | Parts suitable for use solely or principally with the engines of heading 8407 or 8408 | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8413 | Pumps for dispensing fuel or lubricants of the type used in filling stations or garages [8413 11], Fuel, lubricating or cooling medium pumps for internal combustion piston engines [8413 30] | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8413 81 90 | Hydraulic Pumps for Tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8414 20 20 | Other hand pumps | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8415 | Air-conditioning machines, comprising a motor-driven fan and elements for changing the temperature and humidity, including those machines in which the humidity cannot be separately regulated | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8419 12 | Solar water heater and system | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8420 | Hand operated rubber roller | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8422 | Dish washing machines, household [8422 11 00] and other [8422 19 00] | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8424 | Nozzles for drip irrigation equipment or nozzles for sprinklers | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8424 | Sprinklers; drip irrigation system including laterals; mechanical sprayers | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8432 | Agricultural, horticultural or forestry machinery for soil preparation or cultivation; lawn or sports-ground rollers; Parts [8432 90] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8433 | Harvesting or threshing machinery, including straw or fodder balers; grass or hay mowers; parts thereof | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8436 | Other agricultural, horticultural, forestry, poultry-keeping or bee-keeping machinery, including germination plant fitted with mechanical or thermal equipment; poultry incubators and brooders; parts thereof | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8452 | Sewing machines, other than book-sewing machine of heading 8440; furniture, bases and covers specially designed for sewing machines; sewing machines needles and parts of sewing machines | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8479 | Composting Machines | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8507 | Electric accumulators, including separators therefor, whether or not rectangular (including square) other than Lithium-ion battery and other Lithium-ion accumulators including Lithium-ion power banks | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8511 | Electrical ignition or starting equipment of a kind used for spark-ignition or compression-ignition internal combustion engines (for example, ignition magnetos, magneto-dynamos, ignition coils, sparking plugs and glow plugs, starter motors); generators (for example, dynamos, alternators) and cut-outs of a kind used in conjunction with such engines | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8525 60 | Two-way radio (Walkie talkie) used by defence, police and paramilitary forces etc | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8528 | Television sets (including LCD and LED television); Monitors and projectors, not incorporating television reception apparatus; reception apparatus for television, whether or not incorporating radio-broadcast receiver or sound or video recording or reproducing apparatus, set top box for television and Television set (including LCD and LED television). | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 87 | Fuel Cell Motor Vehicles including hydrogen vehicles based on fuel cell technology | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8701 | Tractors (except road tractors for semi-trailers of engine capacity more than 1800 cc) | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8701 | Road tractors for semi-trailers of engine capacity more than 1800 cc | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8702 | Motor vehicles for the transport of ten or more persons, including the driver [other than buses for use in public transport, which exclusively run on Bio-fuels which is already at 18%] | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8703 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of heading 8702), including station wagons and racing cars, other than those mentioned at Sr. Nos. 313, 314, 315, 316,317 and 319 of above table [wherein 28% to 18% is mentioned ] | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8703 | Petrol, Liquefied petroleum gases (LPG) or compressed natural gas (CNG) driven motor vehicles of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm. | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8703 | Diesel driven motor vehicles of engine capacity not exceeding 1500 cc and of length not exceeding 4000 mm. | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8702 or 8703 | Motor vehicles cleared as ambulances duly fitted with all the fitments, furniture and accessories necessary for an ambulance from the factory manufacturing such motor vehicles | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8703 | Three wheeled vehicles | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8703 40, 8703 60 | Motor vehicles with both spark-ignition internal combustion reciprocating piston engine and electric motor as motors for propulsion, of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 870340, 870360 | Motor vehicles with both spark-ignition internal combustion reciprocating piston engine and electric motor as motors for propulsion, of engine capacity exceeding 1200cc or of length exceeding 4000 mm | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8703 50, 8703 70 | Motor vehicles with both compression-ignition internal combustion piston engine [diesel-or semi diesel] and electric motor as motors for propulsion, of engine capacity not exceeding 1500 cc and of length not exceeding 4000 mm | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 870350, 870370 | Motor vehicles with both compression-ignition internal combustion piston engine [diesel-or semi diesel] and electric motor as motors for propulsion, of engine capacity exceeding 1500cc or of length exceeding 4000 mm | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8704 | Motor vehicles for the transport of goods [other than Refrigerated motor vehicles which is already at 18%] | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8706 | Chassis fitted with engines, for the motor vehicles of headings 8701 to 8705 | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8707 | Bodies (including cabs), for the motor vehicles of headings 8701 to 8705 | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 | Parts and accessories of the motor vehicles of headings 8701 to 8705 [other than specified parts of tractors] | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 | Following parts of tractors namely:

| 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 10 10 | Bumpers and parts thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 30 00 | Brakes assembly and its parts thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 40 00 | Gear boxes and parts thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 50 00 | Transaxles and its parts thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 70 00 | Road wheels and parts and accessories thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 91 00 |

Cooling system for tractor engine and parts thereof | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 92 00 | Silencer assembly for tractors and parts thereof | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 93 00 | Clutch assembly and its parts thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 94 00 | Steering wheels and its parts thereof for tractor | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 99 00 | Hydraulic and its parts thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8708 99 00 | Fender, Hood, wrapper, Grill, Side Panel, Extension Plates, Fuel Tank and parts thereof for tractors | 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8710 | Tanks and other armoured fighting vehicles, motorised, whether or not fitted with weapons, and parts of such vehicles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8711 | Motorcycles of engine capacity (including mopeds) and cycles fitted with an auxiliary motor, with or without side-cars, of an engine capacity not exceeding 350cc; side cars | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8711 | Motor cycles of engine capacity exceeding 350 cc | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8712 | Bicycles and other cycles (including delivery tricycles), not motorized | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8714 | Parts and accessories of bicycles and other cycles (including delivery tricycles), not motorised, of 8712 | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8714 | Parts and accessories of vehicles of heading 8711 | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8716 20 00 | Self-loading or self-unloading trailers for agricultural purposes | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8716 80 | Hand propelled vehicles (e.g. hand carts, rickshaws and the like); animal drawn vehicles | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8802 | Aircraft for personal use. | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8806 | Unmanned aircrafts | 28%/ 18% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8903 | Rowing boats and canoes | 28% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8903 | Yacht and other vessels for pleasure or sports | 28% | 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90 or any other Chapter | Blood glucose monitoring system (Glucometer) and test strips | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90 or any other Chapter | Patent Ductus Arteriousus / Atrial Septal Defect occlusion device | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9001 | Contact lenses; Spectacle lenses | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9003 | Frames and mountings for spectacles, goggles or the like, and parts thereof | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9004 | Spectacles, corrective [including goggles for correcting vision] | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9018 | Instruments and appliances used in medical, surgical, dental or veterinary sciences, including scintigraphic apparatus, other electro-medical apparatus and sight-testing instruments | 12% | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||