National Mission for Capacity Building of Bankers zonal workshop begins at Patiala

Gurjit Singh/ royalpatiala.in/ Patiala

After the launch of National Mission for Capacity Building of Bankers(NAMCABS- Phase I) for financing MSME Sector on August 07, 2015 and its successful implementation, Reserve Bank of India has now moved to NAMCABS Phase II. The purpose of these workshops is to develop skills for MSME lending and to improve entrepreneurial sensitivity among the field level functionaries of specialised MSME branches of commercial banks.

Reserve Bank of India, Chandigarh Office has so far conducted 15 NAMCABS workshops at Gurgaon, Ludhiana, Chandigarh,Amritsar, Hisar, Jalandhar, Pathankot, Karnal, Faridabad, Bathinda,Rohtak, Panipat and Ferozepur covering all 45 districts coming under the jurisdiction of RO Chandigarh and trained around 1131Bankers.

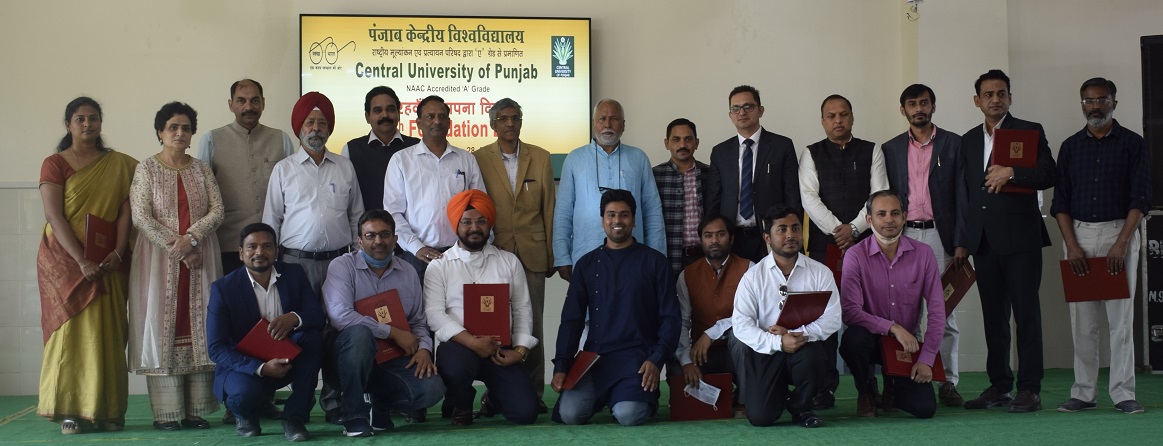

This was the sixteenth workshop which is being organised at Patiala, Punjab in which 5 districts of Punjab State viz Patiala, Mohali, Sangrur, Fatehgarh Sahib and Rupnagar were covered. 69Officers from 23 Banks attended the workshop.

Rachna Dikshit, Regional Director, Reserve Bank of India (Punjab, Haryana and UT of Chandigarh)inaugurated the workshop.In the inauguration ceremony of the workshop, Anil Kumar Yadav, General Manager, Financial Inclusion and Development Department, Reserve Bank of India, Chandigarh, S K Dubey, Chairman, Punjab Gramin Bank, Surender Rana, GM, SBI ( NW-I), LHO, Chandigarh and P K Anand, GM, PNB, SLBC Convener, ZO Ludhiana, Vijay Shanbag, DGM, SBI, Patiala, Surender Kumar Malik, Lead District Manager, SBI, Patiala were present.

In the workshop, various aspects of MSME financing like Important Government, RBI and SIDBI Initiatives, issues and challenges in access to finance for MSMEs, Movable Asset Based Financing and Role of CERSAI, understanding entrepreneurial needs in MSME financing, Assessment of Credit Requirements of MSMEs, credit management & monitoring, Alternative Tech driven approaches to financing MSMEs like TReDS, P2P lending, Fintech etc, Interaction with Industry Associations , Zero Defect & Zero Effect (ZED) and Credit Guarantee Architecture for MSME Financing etcwere discussed by the experts from the respective fields.

Entry and Exit quiz was organised and the winners were distributed prizes.